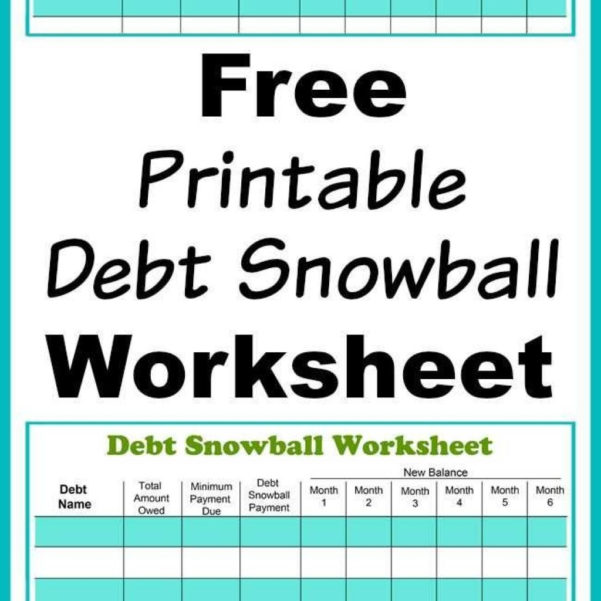

The Accelerated Debt Payoff Spreadsheet is going to be based on one of the most successful and recognizable debt payoff strategies. It is called the debt snowball strategy. It has gone by other names depending upon who has been teaching the strategy at the time but in general, they all share the same common principles. Oct 30, 2012 - Choose from these free debt reduction planning spreadsheets to determine which debt to pay down first using the debt snowball method. The Debt Snowball Calculator calculates the number of months and years it will take to become debt free using your smallest balance, highest interest or any order you choose. Depending on your debt, you will either save big or not much at all. Choose a method that works for you.

It's a world in which you could get lost for hours if you just let your imagination fly.And the modding community has come together to create some of the greatest immersion mods that you could ever wish for. Skyrim se jewelry mod. Some of these mods are not compatible with each other, but most should work well to help you create a lore-friendly environment where everything seems to come to life better than in the base game.Just keep in mind that some of these mods will take up a lot of space and may cause bugs if they don't play well together.You should always create a backup save just in case something goes wrong. Have you ever wanted to feel more immersed in the Skyrim world?Well I can certainly relate.

When it comes to managing your debt, it's easy to feel like you're fighting an uphill battle.

But as more and more individuals find their way out of debt, their advice appears to be resoundingly the same: keep track of your money.

In a world of automatic payments and many credit cards, tracking your expenses feels tricky––especially if numbers aren't your thing. Luckily, technology is your friend here. A debt payoff spreadsheet automatically calculates your cash inflow and payments, so you can stay on top of things.

Whether you're an Excel pro or a newbie, here's how to use the best free debt reduction spreadsheets available online:

Step 1: Find a Budgeting Spreadsheet

The first order of business to paying off any debt is working out a budget. Track your expenses, list it all in a spreadsheet, and compare the final tallies to your monthly cash inflow.

From there, you'll want to track your necessary expenses first. That means essentials like groceries, utilities, insurance, rent, and car payments. Mint's monthly budget template is great for this, with defined boxes like 'cable' and 'pet supplies' for expenses, and 'salary' and 'reimbursements' for income.

Different people may prefer different levels of detail for their budgeting spreadsheets. For instance, the personal monthly budget template by Vertex42 breaks down the 'entertainment' expense category into sub-categories like 'sports' or 'concerts and plays.' The point is to pick one that works for you and determine how much you earn, how much you need to spend, and how much you have left (the difference between the two).

Step 2: Determine a Payment Strategy

Once you've used a budgeting spreadsheet to find out how much money you have left after expenses, you can start paying down your debts.

The primary techniques used for debt reduction are 'snowballing,' in which you are paying off the accounts with the smallest remaining balances first, and 'avalanching,' where you pay down your highest interest debt first. In both cases, you are still making minimum payments to avoid penalties on all your other accounts. Snowballing debt can feel more motivational as you quickly zero out smaller debts.

Step 3: Pick a Debt Payoff Spreadsheet

Now that you've used a budget spreadsheet to determine how much debt payment you can afford every month, and you've picked a debt repayment strategy that makes sense for you, it's time to pick a debt payoff spreadsheet.

Essentially, all debt payoff spreadsheets are the same. Some are labeled as 'credit card payoff spreadsheets,' or 'student loan spreadsheets,' but they all keep track of your outstanding balances and interest rates across accounts to calculate your remaining payments.

What differs between spreadsheets is the organization and level of sophistication. For instance, some will calculate a payment schedule by payment strategy, and some will break down the remaining time to pay off balances by account.

To help you navigate, we've outlined some general buckets and our favorite spreadsheet for each.

Simple

Best Debt Reduction Spreadsheet For Mac Os

When it comes to simplicity, the debt reduction spreadsheets from Squawkfox are excellent. The site includes both a modern spreadsheet with a pie chart to easily visualize how much you owe to various creditors, as well as an 'original' version which has just the table. This provides a concise overall view of your total debt. However, there is no repayment schedule or means to automatically calculate payments according to an avalanche or snowball strategy.

Instructional

Free Spreadsheet For Mac

If you're not very familiar with spreadsheets, the debt reduction spreadsheet from DebtFreeHappens is for you. Developed by a married couple who paid off $107,000 in debt in just three years, this spreadsheet has instructions built right in, and has each loans' outstanding balance and interest rate broken out into its own section. Like Squawkfox, this is a very simple, intuitive spreadsheet, but you'll have to determine payments for an avalanche and snowball strategy on your own.

Detailed

If you're comfortable and have your bearings with debt reduction spreadsheets, the Vertex42 Debt Reduction Calculator is an excellent resource. The two big benefits of this spreadsheet are that it creates a payment schedule based on your selected strategy and outlines how long it will take to pay off each of your debts.

There are four tabs at the bottom, including one for 'help,' so don't quit if you feel daunted at first.

Customizable

The debt tracker from It's Your Money is a little harder than the rest. There are seven tabs in the spreadsheet, and the instructions on the page itself are long and fairly comprehensive. However, if you are someone who cares about tracking a large amount of debt long term, this is essentially a professional-grade software that's absolutely free. You can organize debt by category, organize your payment schedule by various criteria like current balance or interest payments per month, and there are well-designed tabs to show your payment schedule for each loan. This is a great option if you have a mortgage, business loans, or plan to have a revolving debt payment plan.

If you're struggling with debt reduction and you're looking for more resources on how to regain your financial foothold, check out our resources, such as how to build a budget,how to rebuild credit quickly, and how to build good spending habits.

Best Debt Reduction Spreadsheet

Next related article

How to Pay Off Debt: 3 Simple Strategies | RISE

Here's 3 effective strategies to reduce your debt burden and pay off debt.

Focused on providing information for anyone in need of debt relief, Jackson Maven writes a blog on debt settlement, debt consolidation, tax debt relief and student loan debt which helps to find the debt solution that fits their unique needs no matter the amount of debt they are in.

Debt is something that you might not be proud of. This is why clearing debts is very important. Many debtors prefer taking guidance from the professionals for settling their debts. Depending on the financial situation of the borrower, credit counseling agencies often suggest the debtor undergo a debt management program. These programs generally last for 3-5 years.

The agencies help the borrower in clearing off their debt by either negotiating with creditors over reducing the original debt amount or decreasing interest rates, waving off of late payment charges, etc.

Credit counseling agencies

A good credit counseling company not only helps the debtor in clearing off the debt but also help them in controlling expenses and managing their finances. In exchange for the services provided by them, most of these agencies charge a monthly fee (around $50) to their clients.

Managing debts can be a very stressful job, especially for those who do not have a financial background. The debts can be of medical bills, unsecured loans, and most common credit card bills. If you are a person who believes in overcoming hurdles all by yourself, then you may opt for a DIY. In other words, you can create your very own debt management plan.

Different people may prefer different levels of detail for their budgeting spreadsheets. For instance, the personal monthly budget template by Vertex42 breaks down the 'entertainment' expense category into sub-categories like 'sports' or 'concerts and plays.' The point is to pick one that works for you and determine how much you earn, how much you need to spend, and how much you have left (the difference between the two).

Step 2: Determine a Payment Strategy

Once you've used a budgeting spreadsheet to find out how much money you have left after expenses, you can start paying down your debts.

The primary techniques used for debt reduction are 'snowballing,' in which you are paying off the accounts with the smallest remaining balances first, and 'avalanching,' where you pay down your highest interest debt first. In both cases, you are still making minimum payments to avoid penalties on all your other accounts. Snowballing debt can feel more motivational as you quickly zero out smaller debts.

Step 3: Pick a Debt Payoff Spreadsheet

Now that you've used a budget spreadsheet to determine how much debt payment you can afford every month, and you've picked a debt repayment strategy that makes sense for you, it's time to pick a debt payoff spreadsheet.

Essentially, all debt payoff spreadsheets are the same. Some are labeled as 'credit card payoff spreadsheets,' or 'student loan spreadsheets,' but they all keep track of your outstanding balances and interest rates across accounts to calculate your remaining payments.

What differs between spreadsheets is the organization and level of sophistication. For instance, some will calculate a payment schedule by payment strategy, and some will break down the remaining time to pay off balances by account.

To help you navigate, we've outlined some general buckets and our favorite spreadsheet for each.

Simple

Best Debt Reduction Spreadsheet For Mac Os

When it comes to simplicity, the debt reduction spreadsheets from Squawkfox are excellent. The site includes both a modern spreadsheet with a pie chart to easily visualize how much you owe to various creditors, as well as an 'original' version which has just the table. This provides a concise overall view of your total debt. However, there is no repayment schedule or means to automatically calculate payments according to an avalanche or snowball strategy.

Instructional

Free Spreadsheet For Mac

If you're not very familiar with spreadsheets, the debt reduction spreadsheet from DebtFreeHappens is for you. Developed by a married couple who paid off $107,000 in debt in just three years, this spreadsheet has instructions built right in, and has each loans' outstanding balance and interest rate broken out into its own section. Like Squawkfox, this is a very simple, intuitive spreadsheet, but you'll have to determine payments for an avalanche and snowball strategy on your own.

Detailed

If you're comfortable and have your bearings with debt reduction spreadsheets, the Vertex42 Debt Reduction Calculator is an excellent resource. The two big benefits of this spreadsheet are that it creates a payment schedule based on your selected strategy and outlines how long it will take to pay off each of your debts.

There are four tabs at the bottom, including one for 'help,' so don't quit if you feel daunted at first.

Customizable

The debt tracker from It's Your Money is a little harder than the rest. There are seven tabs in the spreadsheet, and the instructions on the page itself are long and fairly comprehensive. However, if you are someone who cares about tracking a large amount of debt long term, this is essentially a professional-grade software that's absolutely free. You can organize debt by category, organize your payment schedule by various criteria like current balance or interest payments per month, and there are well-designed tabs to show your payment schedule for each loan. This is a great option if you have a mortgage, business loans, or plan to have a revolving debt payment plan.

If you're struggling with debt reduction and you're looking for more resources on how to regain your financial foothold, check out our resources, such as how to build a budget,how to rebuild credit quickly, and how to build good spending habits.

Best Debt Reduction Spreadsheet

Next related article

How to Pay Off Debt: 3 Simple Strategies | RISE

Here's 3 effective strategies to reduce your debt burden and pay off debt.

Focused on providing information for anyone in need of debt relief, Jackson Maven writes a blog on debt settlement, debt consolidation, tax debt relief and student loan debt which helps to find the debt solution that fits their unique needs no matter the amount of debt they are in.

Debt is something that you might not be proud of. This is why clearing debts is very important. Many debtors prefer taking guidance from the professionals for settling their debts. Depending on the financial situation of the borrower, credit counseling agencies often suggest the debtor undergo a debt management program. These programs generally last for 3-5 years.

The agencies help the borrower in clearing off their debt by either negotiating with creditors over reducing the original debt amount or decreasing interest rates, waving off of late payment charges, etc.

Credit counseling agencies

A good credit counseling company not only helps the debtor in clearing off the debt but also help them in controlling expenses and managing their finances. In exchange for the services provided by them, most of these agencies charge a monthly fee (around $50) to their clients.

Managing debts can be a very stressful job, especially for those who do not have a financial background. The debts can be of medical bills, unsecured loans, and most common credit card bills. If you are a person who believes in overcoming hurdles all by yourself, then you may opt for a DIY. In other words, you can create your very own debt management plan.

The most common thing that scares an individual as far as managing finances or paying off debt is concerned is the ‘calculations.' Examples are: calculating the interest levied, the ratio of income to expenditures, total savings needed on a monthly basis for settling debt, etc. can be quite tiresome. There is no need to be disheartened, however. Technology has debt management much easier. Several spreadsheets are available on the internet that can help you in creating your own debt-settling plan and also in planning your credit repair strategy.

Use a debt reduction spreadsheet

Besides being easy to use, these debt reduction spreadsheets are available for free. They can be used with Google Sheets, Microsoft Excel, or Open Office Calc. They come with built-in formulas. This means the user doesn't have to do any calculations; the spreadsheets take care of it. But before you start your journey of creating and executing your debt management plan, you will need two essential things.

Firstly, you need to be determined to get rid of your debt. The duration of a debt management program can last over 3-5 years. During that period having control over expenses and a motivation to save more money is very crucial. Until and unless you are determined to clear off your debt, overcoming the temptation of purchasing could be quite difficult.

Secondly, before you start planning, you need to have a clear understanding of the total bills or loan installments pending on your behalf. For this, you need to ask all the creditors to provide the bills and statements. Once you have all the required financial details, you can start by filling those details in your spreadsheet.